In order to justify the energy of deciding upon specific shares, it is really really worth striving to beat the returns from a industry index fund. But even the ideal inventory picker will only gain with some selections. So we wouldn’t blame lengthy phrase Global Organization Machines Company (NYSE:IBM) shareholders for doubting their determination to keep, with the stock down 16% in excess of a 50 percent 10 years.

If the earlier week is something to go by, trader sentiment for International Enterprise Machines is just not favourable, so let’s see if there’s a mismatch amongst fundamentals and the share rate.

Look at out our most current investigation for Global Business enterprise Devices

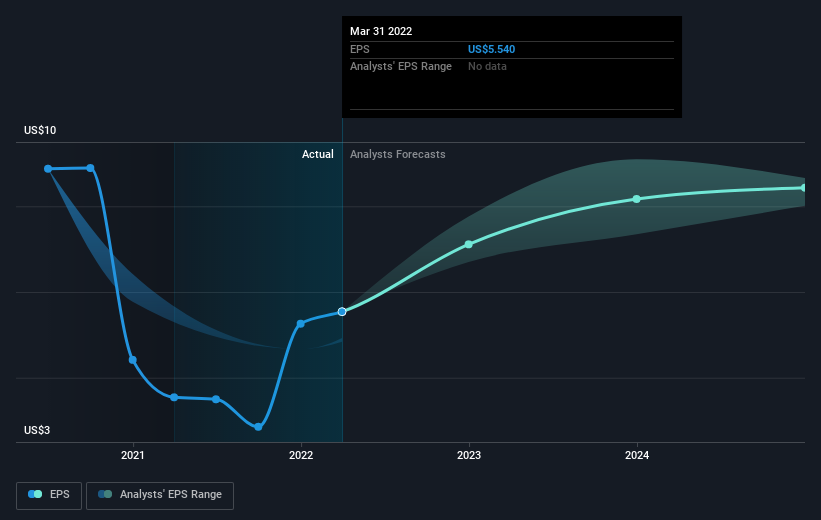

Although marketplaces are a potent pricing system, share costs mirror investor sentiment, not just underlying business enterprise effectiveness. A single flawed but realistic way to evaluate how sentiment close to a firm has adjusted is to examine the earnings for each share (EPS) with the share selling price.

Wanting back again 5 years, equally Intercontinental Organization Machines’ share value and EPS declined the latter at a charge of 15% for each calendar year. This drop in the EPS is worse than the 3% compound annual share price tag slide. So the market may possibly earlier have envisioned a fall, or else it expects the problem will boost.

The graphic underneath depicts how EPS has changed over time (unveil the exact values by clicking on the graphic).

We know that Global Organization Equipment has improved its base line recently, but is it likely to grow earnings? You could verify out this free report demonstrating analyst earnings forecasts.

What About Dividends?

It is critical to think about the whole shareholder return, as properly as the share value return, for any presented stock. While the share price return only reflects the change in the share price, the TSR features the benefit of dividends (assuming they have been reinvested) and the advantage of any discounted money boosting or spin-off. It can be good to say that the TSR gives a additional full image for stocks that pay back a dividend. We be aware that for Global Small business Devices the TSR about the final 5 decades was 12%, which is far better than the share value return described higher than. This is largely a result of its dividend payments!

A Different Viewpoint

Even though it really is hardly ever wonderful to choose a loss, Worldwide Enterprise Machines shareholders can consider ease and comfort that , like dividends,their trailing twelve thirty day period loss of 2.4% wasn’t as terrible as the marketplace loss of all-around 12%. For a longer period phrase investors wouldn’t be so upset, considering that they would have produced 2%, just about every yr, above 5 many years. It could be that the business enterprise is just struggling with some quick term troubles, but shareholders should really hold a near eye on the fundamentals. It really is often interesting to track share value effectiveness over the lengthier term. But to comprehend Intercontinental Organization Equipment far better, we require to look at quite a few other variables. To that conclude, you should be knowledgeable of the 2 warning signs we’ve noticed with Worldwide Company Devices .

If you are like me, then you will not want to skip this no cost listing of escalating providers that insiders are shopping for.

Be sure to notice, the marketplace returns quoted in this article mirror the industry weighted average returns of stocks that at this time trade on US exchanges.

Have feedback on this report? Worried about the content? Get in touch with us specifically. Alternatively, electronic mail editorial-crew (at) simplywallst.com.

This write-up by Merely Wall St is common in character. We present commentary primarily based on historical facts and analyst forecasts only employing an unbiased methodology and our articles are not intended to be money assistance. It does not constitute a advice to get or promote any stock, and does not consider account of your aims, or your financial problem. We goal to provide you extended-term focused evaluation pushed by basic info. Be aware that our examination may possibly not factor in the newest rate-sensitive business announcements or qualitative substance. Only Wall St has no situation in any stocks mentioned.