Dzmitry Dzemidovich/iStock through Getty Photos

This week, there ended up 3 crucial knowledge releases.

CPI is nevertheless increasing:

The Customer Rate Index for All City Customers (CPI-U) elevated 1.2 per cent in March on a seasonally altered basis right after mounting .8 p.c in February, the U.S. Bureau of Labor Data described these days. More than the previous 12 months, the all products index increased 8.5 p.c in advance of seasonal adjustment.

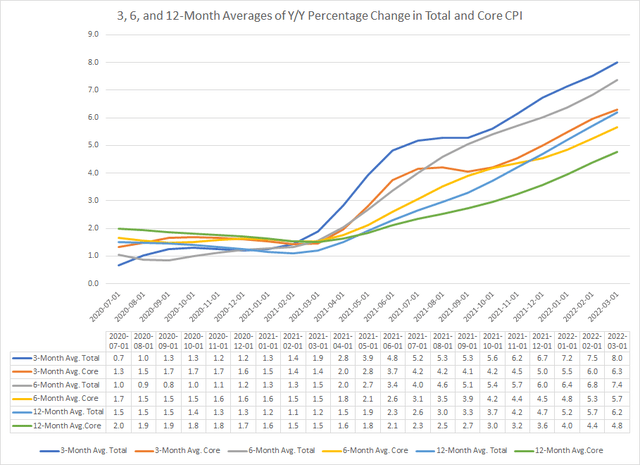

This is the chart of the details:

3, 6, and 12-month typical Y/Y proportion transform in complete and main CPI (Facts from FRED author’s calculations)

The earlier mentioned chart reveals the 3, 6, and 12-month regular Y/Y share change in the full and core CPI rate indexes. All are going increased although the shorter going averages are above the for a longer time transferring averages. This indicates that value pressures will go on to increase for at least a several months.

The Producer Value Index for final demand from customers improved 1.4 per cent in March, seasonally adjusted, the U.S. Bureau of Labor Data claimed now. This rise adopted developments of .9 % in February and 1.2 per cent in January. (See table A.) On an unadjusted foundation, last need costs moved up 11.2 per cent for the 12 months finished in March, the largest maximize since 12-thirty day period knowledge ended up initial calculated in November 2010.

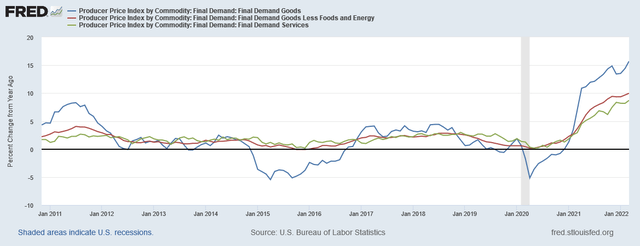

Below is the chart:

A few PPI indexes (FRED)

The above details displays that a few important PPIs for last demand are soaring at potent clips.

Blended, the price facts supports the Fed’s present-day coverage of elevating prices. Bear in mind that a amount of Fed presidents have said they would be eager to vote for a 50 foundation position raise at an future conference.

Retail sales greater:

Retail product sales launch (Census)

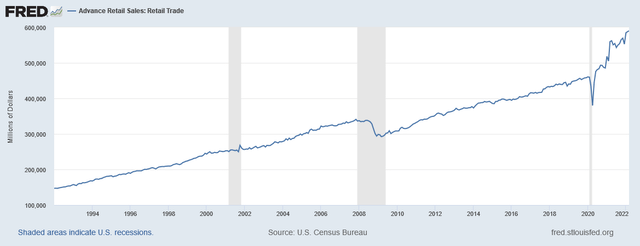

Here’s the chart:

Retail income (FRED)

This coincidental information is at a collection high.

Now (and for the foreseeable long run) the most important situation for the marketplaces is the Federal Reserve’s fascination charge plan. The vintage buying and selling tips of “Do not struggle the Fed” is incredibly substantially in perform. This week’s value data implies supports strong rate hikes from the Fed for the future handful of months.

Let’s transform to the technical details.

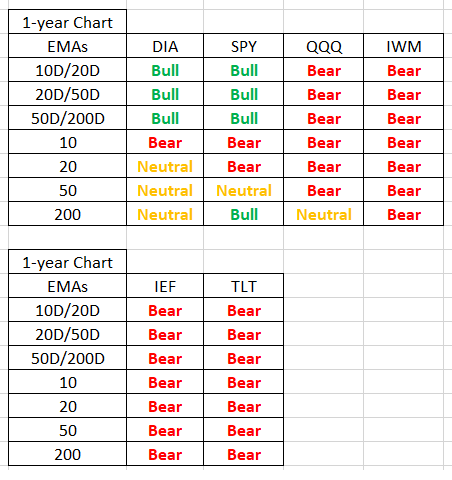

EMA photo for the key index and bond industry ETFs (Stockcharts author’s calculations )

Let us begin at the bottom, noting that the bond current market is clearly in a bear current market. The four equity market place ETFs are organized from conservative (remaining) to aggressive (right). The more aggressive the index, the a lot more bearish it is.

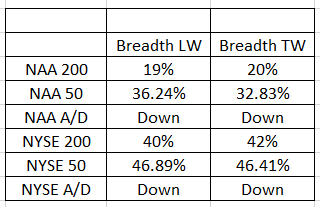

Sector Breadth Indicators for NYSE and QQQ (Stockcharts)

Industry breadth is soft.

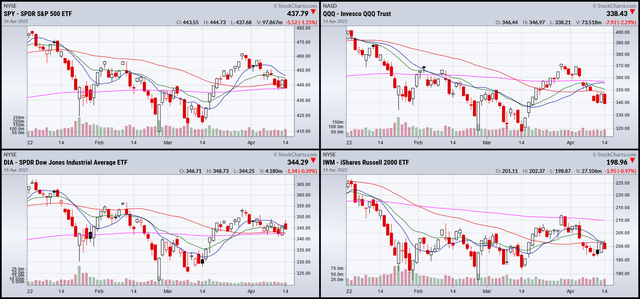

Now, let’s flip to the charts.

YTD for SPY, QQQ, DIA, and IWM (Stockcharts)

Year to day, the trend is lessen. The markets declined from the beginning of January till mid-March. They all experimented with to rally but the progress stalled at the finish of last thirty day period. Selling prices have been trending lessen given that, while the drop has been disciplined.

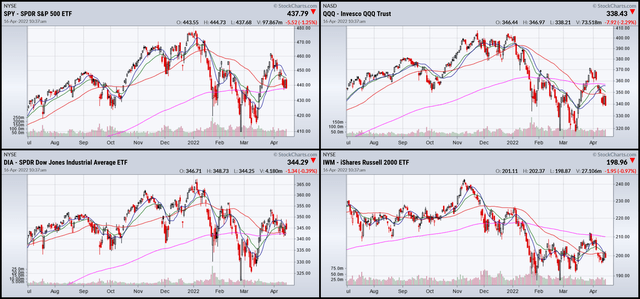

1-calendar year SPY, QQQ, DIA, and IWM (Stockcharts)

The 1-12 months charts present that price ranges peaked at the conclude of final 12 months and have been trending decreased given that.

Only a single index (the IWM) is decisively under its 200-day EMA. The other a few are using their respective 200-working day EMAs as a center of gravity, fluctuating close to it. But from the backdrop of a hawkish Fed and enhanced danger aversion, the total tone is at very best neutral.