Numerous central banks have ventured into strange territory in the opening months of this yr, announcing currency sales in advance as they tread a delicate line among dulling the impact of a sliding greenback and dodging the ire of the US Treasury.

Given that the start off of January, central financial institutions in Chile, Israel and Sweden have all outlined strategies to provide their currencies in overseas exchange markets. Policymakers in Poland also issued a verbal warning to zloty bulls that they could intervene.

The moves underline the force on tiny currencies that are pushing bigger in reaction to a wide slide in the dollar, holding down inflation in their domestic economies and threatening exports at a time when worldwide trade remains fragile. But the progress warnings also advise policymakers are keen to stay clear of becoming labelled forex manipulators — a title Switzerland and Vietnam attained from the US final calendar year.

“We are in an intriguing second when it comes to central banking institutions straddling the high-quality line involving [foreign exchange] intervention and [foreign exchange] manipulation,” said Alan Ruskin, chief international strategist at Deutsche Financial institution in a modern take note to customers.

“While each and every of the [central banks] has distinctive motivations, they do seem to be deftly dancing about possible censure from the US. This is a slippery slope,” he extra.

Beneath stress from the Federal Reserve’s pledges to maintain interest costs minimal perhaps for years to arrive, the greenback has weakened just about 7 per cent about the past yr versus a basket of friends, sending the currencies of rising marketplaces and trade-delicate economies soaring.

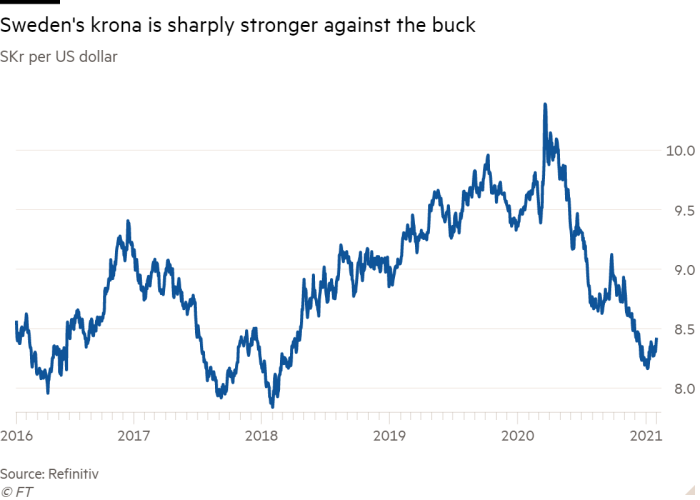

In January, Israel’s shekel strike its strongest concentrations since the greenback since 2008, just after surging final calendar year as the greenback shed 7 for each cent versus the forex. The buck also misplaced more than 12 for each cent towards the Swedish krona in 2020 and a lot more than 5 for every cent towards the Chilean peso.

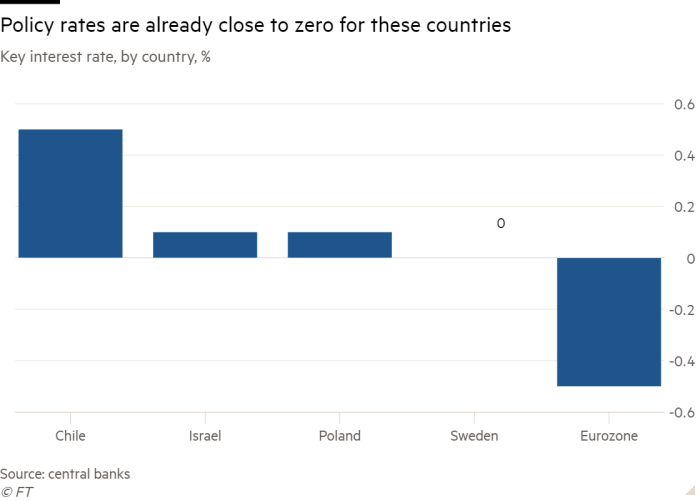

Policymakers have tiny room to lower interest prices further more without having shifting beneath zero, with some obtaining by now slashed them in reaction to the coronavirus pandemic. That leaves outright currency gross sales as a crucial solution, even while unilateral interventions almost never thrive in turning the way of the dominant dollar.

Sweden’s central bank, the Riksbank, surprised analysts when it explained last thirty day period it would amass overseas currency reserves over the subsequent three years by selling SKr60bn ($7.2bn) each individual year till December 2023.

Swedish policymakers were being at pains to emphasise that this was not a shift aimed at weakening their forex — as this sort of ways would be in opposition to the arrangement of G20 nations around the world and could draw in retribution — but about eradicating the have to have for the Riksbank to borrow from the Swedish financial debt office environment to finance its fx reserves.

“This is not currency intervention and we have been crystal clear that this is not meant to have a financial policy effect,” Heidi Elmer, head of the Riksbank’s sector office instructed the Economical Moments. “Our objective is to make certain that we have properly financed forex reserves.”

But Robert Bergqvist, a senior economist at SEB, mentioned that the Riksbank had been involved about the impact of a strong krona on inflation and the possibility of getting to slice its essential price under zero once more, tiny extra than a year after it became the to start with nation to elevate its then negative price out of the deep freeze.

“This is a bit controversial for the Riksbank to do since the currency gross sales will act as a headwind and make a rate slash considerably less possible,” he said.

Chilean policymakers also made a decision to bolster currency reserves by paying for $12bn about 15 months, citing predicted political turbulence. Israel, in the meantime, highlighted risks stemming from the shekel’s increase when it mentioned it would acquire $30bn worthy of of international currencies this 12 months. By informing markets in progress about their intentions, central bankers have designed a headwind for these currencies.

“The dilemma you have to ask on your own is: would central banking institutions be performing this way if the trade price was heading the other way? I think not,” Deutsche Bank’s Mr Ruskin reported.

Currency interventions carry a stigma simply because big central banks frequently agree to allow for trade rates to be sector-driven. “I see an surroundings in which currency intervention is starting to be a additional important resource for macro management,” mentioned Ed Al-Hussainy, a senior currencies and charges analyst at Columbia Threadneedle.

“That may possibly be a well mannered way of indicating that forex wars are a lot more most likely,” he additional.

Goldman Sachs analysts also count on additional intervention from emerging markets central financial institutions if the dollar carries on to decrease in line with their forecasts. Deutsche Bank’s Mr Ruskin stated the danger is that “surrogate” intervention from a handful of modest central banks could spread and attract in policymakers from all parts of the globe into aggressive currency devaluation.

“What we are seeing is only the opening gambit of central banking institutions responding to a weaker dollar ecosystem,” Mr Ruskin claimed.