Following a long time in Donald Trump’s crosshairs, China’s forex is greeting Joe Biden on radically distinct phrases.

The renminbi, at present at a 30-month higher in opposition to the greenback, has been boosted by anticipations that a Democratic administration could demonstrate much less volatile in its dealings with China as properly as by the country’s sturdy financial restoration from the Covid-19 pandemic.

But traders are divided in excess of irrespective of whether the wind will remain in the renminbi’s sails in 2021, with much relying on the trajectory of US-China relations and Beijing’s plan priorities.

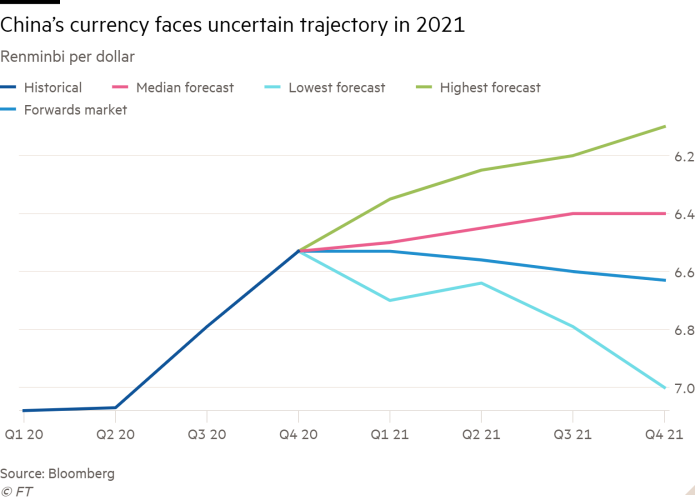

Economists’ predictions for the Chinese forex this 12 months vary commonly, from a 7.2 for every cent fall to a 6.6 per cent climb against the dollar. The median forecast, in accordance to analysts polled by Bloomberg, pegs a 2 for each cent increase to Rmb6.4 per greenback.

Listed here are the components that will figure out China’s trade level this yr.

Will Biden seek to mend ties with China?

China’s forex notched its very best 6 months on history in the next 50 percent of 2020 as investors wager that Mr Biden would unseat Mr Trump, whose tariffs on Chinese products strike the renminbi.

“The Biden administration is possible to be a great deal extra balanced in its approach” to China, stated Mansoor Mohi-uddin, main economist at Financial institution of Singapore.

But further more strength in the renminbi would involve a lot more beneficial developments in US-China relations, he extra, this sort of as the elimination of tariffs imposed by the Trump administration, which at a single place designated Beijing a currency manipulator.

Analysts are sceptical of a overall tariff rollback, while Mr Trump packed his remaining days in office environment with a flurry of steps focusing on Chinese businesses.

Janet Yellen, Mr Biden’s nominee for Treasury secretary, told the Senate in the course of her confirmation hearing this week that the new administration would “take on China’s abusive, unfair and illegal practices” and was prepared to use the “full array of tools” to redress them.

“Is Biden going to reverse those imminently? Or will he worry that reversing people will generate an perception that he has a softer stance to China?” asked Michelle Lam, Better China economist at Société Générale, of US sanctions. “It’s still much too early to say nearly anything for certain.”

Will a slipping dollar spur desire for Chinese property?

A significant determinant in irrespective of whether the renminbi will improve further more is the trajectory of the dollar, analysts say, and how it impacts world demand for Chinese assets.

With the Democrats using handle of the Senate, Mr Biden will have a improved opportunity of launching nearly $2tn in fiscal stimulus, which could accelerate inflation and weigh on the greenback.

“To a massive extent the power in the renminbi you are observing now is a reflection of dollar weakness . . . now the concern is no matter if we’re going to see that weak point increase even more,” reported SocGen’s Ms Lam.

A weaker greenback, put together with anticipations that the Federal Reserve will retain fascination fees at extremely-low levels, tends to make it rather additional attractive for investors to hold assets denominated in renminbi.

Goldman Sachs analyst Danny Suwanapruti has forecast worldwide inflows into China’s renminbi-denominated onshore financial debt market place will arrive at $140bn in 2021, up from about $130bn very last 12 months.

Regular monthly inflows into onshore personal debt will normal $5-10bn this year, he instructed. The rate could accelerate to $10-15bn from Oct, when Chinese governing administration bonds will be included into FTSE Russell’s influential Planet Federal government Bond index.

That will enable buoy sturdy overseas demand from customers for renminbi, he thinks. Goldman Sachs thinks the Chinese currency will reinforce to Rmb6.2 for every greenback by calendar year end.

“Chinese fastened money markets will dominate [flows into emerging markets] in 2021, as they did in 2020,” mentioned Mr Suwanapruti.

Far more broadly, China’s web international trade inflows jumped to about $93bn in December, the major every month surge on file according to a Goldman Sachs estimate dependent on knowledge from the Point out Administration of International Exchange achieving back again to 2010.

What are Beijing’s coverage priorities?

China was much more restrained than the US in its fiscal reaction to the coronavirus pandemic. Rapid and serious lockdowns aided provide the virus underneath manage and manufactured China the only huge economy to stay clear of a economic downturn in 2020.

That indicates China could now concentrate on reining in fiscal pitfalls, which have been brought to the fore by a string of higher-profile defaults in late 2020, even if the scrutiny weighed on expansion.

“The priority of policymakers is to comprise leverage and target on the sustainability of personal debt, given that the overall economy has fairly considerably previously normalised,” said Ms Lam of SocGen.

When that does not always imply that China’s central bank will thrust interest rates larger this calendar year, analysts think they are likely to remain very well previously mentioned their extremely-reduced counterparts in the US and Europe, supporting renminbi strength.

There also continues to be the dilemma of Beijing’s level of comfort with a more robust renminbi, whose value is in portion guided by policymakers.

Although China has largely stepped back again from lively administration of the currency in modern a long time, it still sets a day by day fix versus the greenback, in opposition to which it can bolster or weaken up to 2 per cent.

Nevertheless, analysts imagine the People’s Financial institution of China will keep a arms-off strategy to handling the currency, with any strain on exporters due to the fact of its strength unlikely to prompt intervention.

Becky Liu, head of China macro tactic at Standard Chartered, reported an financial rebound in formulated market place economies as Covid-19 vaccines are distributed would necessarily mean “demand for Chinese merchandise could even continue to be strong for longer than expected”.

The country’s regular trade surplus strike its highest at any time amount in December on big global need for health care goods. Renminbi “appreciation has not reached an end”, additional Ms Liu, who thinks the forex will increase to Rmb6.3 for each dollar by the shut of the initial fifty percent.