By Kagondu Njagi for Reuters

Sitting on a reduced bench at her shop in a Nairobi slum, Grace Wangari sifted via a handful of grains that a waiting purchaser experienced just purchased.

As she poured them into a purchasing bag, the shopper scrolled by means of her cell phone to spend for the order.

People today wear encounter masks when queueing through a mass tests for Covid-19. File image.

Photo: AFP

Normally, Wangari would have been paid in shilling notes, Kenya’s tricky forex, but in some techniques she preferred the electronic payment that was right away transferred to her telephone.

“I am happy with this transaction for the reason that there is no hazard of losing my inventory to conmen or people today who have arrive to get items on credit rating,” stated Wangari, a center-aged trader in Mukuru Kayiaba, one of the city’s poorest slums.

The transaction occurred via Sarafu, a blockchain-based neighborhood forex that is assisting countless numbers of Kenyan slum dwellers pay back for food items, h2o and sanitary items as they battle by way of the Covid-19 economic downturn.

Each week, households are issued with digital vouchers worth 400 Kenyan shillings ($NZ5.60), which they can use to buy important merchandise, claimed Roy Odhiambo, an innovation officer at Kenya Purple Cross Culture (KRCS), 1 of the teams guiding the undertaking.

Vendors can then deliver the vouchers to Grassroots Economics, the Nairobi-based social business that co-made Sarafu (“coins” in English) with US-based engineering company BlockScience, and redeem them for income.

Odhiambo claimed a lot more than a 3rd of the distributors in Mukuru are already signed up to the task, which introduced in 2019 with the purpose of helping battling people get hold of day to day essentials without the need of worrying about getting income on hand.

Now the challenge is supplying a lifeline for households attempting to cope with the fiscal agony of the pandemic, he observed.

Antony Ngoka, a area coordinator with Grassroots Economics, said hundreds of slum inhabitants, who are generally casual personnel, have shed their employment in the course of the pandemic.

Unable to get loans from traditional banking institutions, numerous turn into simple prey for bank loan sharks, he extra.

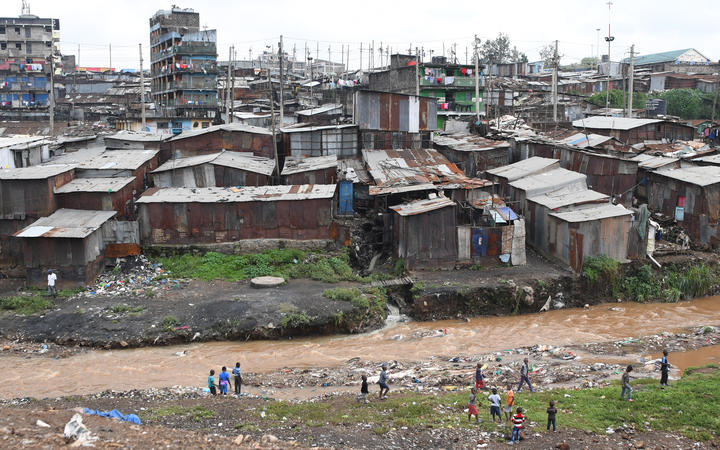

Young children engage in up coming to Nairobi river in the Mathare valley slum in Nairobi, Kenya. File photograph

Image: AFP

Legal rights activist and social worker Nelson Ochieng’ in Kibera, Nairobi’s major slum, explained blockchain could enable weak Kenyans steer clear of economic exploitation.

“Blockchain can foster community trade by tapping means that are ignored by mainstream firms. It also improves stages of rely on amid battling communities,” he said.

Protected and transparent

In Mukuru Kayiaba slum, about 9km absent from Nairobi city centre, some 4000 people have registered with Sarafu, according to Odhiambo of KRCS.

Formulated with funding from world wide authorities donors, the platform can make an regular of up to 1 million Kenyan shillings ($12,600) in everyday transactions, Odhiambo stated.

As opposed to cash assist, which can be put in on anything at all, Sarafu can only be utilised to pay for essentials this sort of as foodstuff, health and fitness supplies and academic methods, he explained.

And, he extra, mainly because the system runs on blockchain, which means all transactions are tracked and transparent, that makes sure people are investing the funds only on necessities.

Odhiambo stated KRCS is at present functioning with the Danish Crimson Cross and Innovation Norway, the government’s business enterprise improvement agency, to roll out Sarafu throughout Kenya.

But, seeing the system as a danger, personal loan sharks are applying political and money manipulation to entice Kenyans absent from it, stated Ochieng’, the legal rights activist.

Casual lenders recruit persons to distribute rumours that blockchain is a Ponzi plan with no backing from regional leaders, a tactic that has successfully stifled the uptake of other blockchain-dependent initiatives in the past, he described.

“The aim of personal loan sharks is to divert individuals from improvements that are supporting them entry simple services in the slums without having possessing to spend desire,” Ochieng’ reported.

They also pull in customers by presenting substantially higher sums than they can get by way of Sarafu, with exorbitant interest rates, he additional.

Violet Muraya, who sells drinking water in Mukuru slum, mentioned casual loan companies can offer financial loans up to 10 instances more substantial than anything accessible via the neighborhood forex.

“When men and women have emergencies and will need large amounts of cash, they can’t use Sarafu. So, they go to personal loan sharks for enable and conclusion up currently being trapped in economic slavery,” mentioned Muraya.

Odhiambo claimed the Kenya Red Cross Society is functioning schooling and awareness-increasing campaigns in parts in which the project has been rolled out, to reassure customers that the system is risk-free and honest.

“At to start with there was resistance … mainly because of the propaganda. But the group has acknowledged this cashless transaction due to the fact they know it is not some sort of betting or mortgage facility,” he stated.

‘No a single is going to sleep hungry’

At Isaac Makavu’s food stuff kiosk in Mukuru, clients lined up to purchase his steaming rolls of baked flat bread, chatting about an future Premier League soccer video game and sharing amusing stories about their working day.

Makavu mentioned Sarafu has helped folks in his group keep away from eviction throughout the pandemic by making it possible for them to save their dollars.

Some appear jointly to pay back each other’s hire by table banking, a form of personal savings scheme in which a group contributes a set amount of funds each thirty day period and then takes advantage of that funds to assist associates who have to have it.

Charities say evictions have been rife in elements of East Africa through the pandemic. In one particular instance in May 2020, Human Rights Enjoy reported extra than 8000 men and women living in two Nairobi slums ended up evicted from their residences.

“But there have been no evictions in spots where Sarafu is staying made use of by slum communities mainly because they ended up capable to shell out their hire on time,” Makavu reported.

“No a person is heading to snooze hungry right here for the reason that they have neighborhood forex.”

– Thomson Reuters Foundation