Gold is proving remarkably resilient, attaining virtually 7% this yr as traders shrug off surging genuine yields and strengthening dollar to focus on political and financial challenges.

Although classic produce and currency drivers recommend bullion is overvalued, desire for the haven asset stays strong. That’s because gold prospective buyers piling into exchange-traded resources are having a pessimistic watch of the US Federal Reserve’s capacity to neat decades-significant inflation with no hurting the financial state. For them, gold is a hedge towards soaring prices and lower expansion.

“Gold has proficiently been questioning the Fed’s capacity to increase true actual charges, while offering a smooth landing for the financial system,” reported Marcus Garvey, head of metals system at Macquarie Team Ltd. “You could argue gold has very greatly priced the Fed not currently being prosperous.”

Increasing geopolitical uncertainty pursuing Russia’s invasion of Ukraine is also driving strategic portfolio diversification by buyers who are a lot less concerned about increased serious fees, in accordance to Joni Teves, an analyst at UBS Team AG.

The international financial outlook remains murky as a robust recovery from the pandemic is tempered by the war in Ukraine and China’s continuing fight against Covid-19. Any escalation in the conflict, which is presently weighing on expansion forecasts, could additional burnish the charm of gold.

Sanctions on Russia could also herald a more much-achieving change that’s bolstering bullion. Influential analysts like Credit rating Suisse Group AG’s Zoltan Pozsar forecast that the seizure of about 50 percent the Russian central bank’s foreign trade reserves will end result in a new financial paradigm exactly where gold plays a higher purpose.

“The current value has much less to do with inflation and growing yields and much more to do with geopolitical pitfalls and the Russian central financial institution pivoting towards accumulating alternate sources of wealth,” mentioned David Chao, international market strategist for Asia Pacific ex-Japan at Invesco Ltd. “I’m a bit stunned that gold is not at larger rates.”

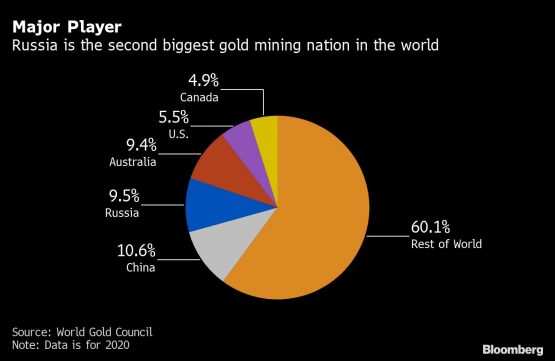

At the margin, the blacklisting by western marketplaces of gold from Russia – the world’s No. 2 producer — may perhaps also be possessing an effect.

Continue to, for numerous observers, there are indicators that gold’s run may possibly quickly conclusion. Inflation-adjusted Treasury yields turned beneficial for the initially time in two several years Wednesday, although the dollar is investing close to the best given that July 2020, earning bullion — which is priced in the US currency — much more costly for foreign traders.

The final result of the Fed meeting in about two months time will be gold’s future significant test as coverage makers look for to tame inflation. Income marketplace traders are betting the US central financial institution will deliver a supersized interest-price hike at the conference to help suppress inflation working at the quickest tempo in 4 many years.

“We think the overall economy will stay resilient though price pressures are displaying some early signs of peaking,” Carsten Menke, an analyst at Julius Baer Group Ltd, wrote in a take note. “Assuming no worsening of the war in Ukraine, the desire for gold from protected-haven seekers should really fade.”

On Thursday, spot gold slipped .1% to $1 955.99 an ounce as of 9:02 a.m. in Singapore. Silver eased, even though platinum and palladium edged larger.

At the moment, gold is pricey relative to actual rates but that hole is most likely to slim about time, according to Luc Luyet, Fx strategist at Pictet Wealth Administration. “Over the lengthier phrase, the slowing growth momentum and elevated inflation will make normalisation of financial policy in the US specifically difficult, which must favor gold,” he stated.

© 2022 Bloomberg