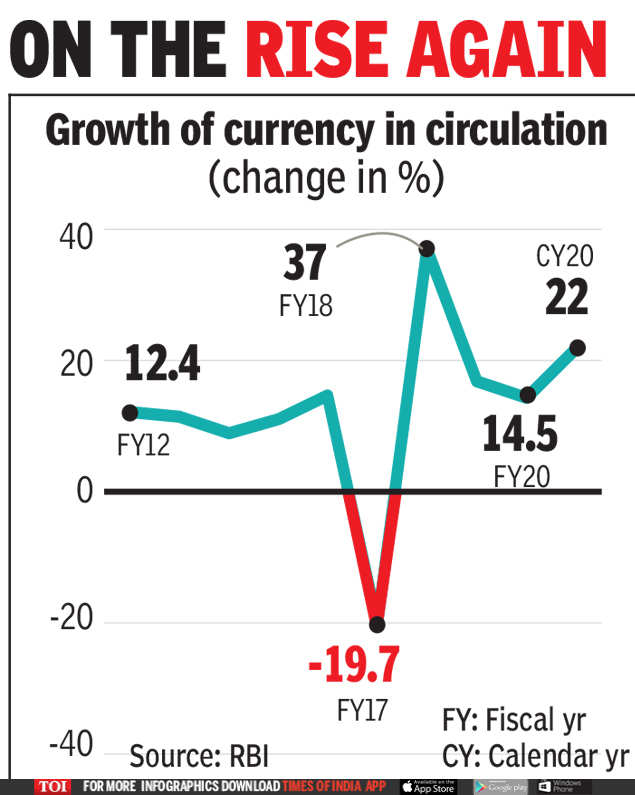

In accordance to details released by the Reserve Financial institution of India (RBI), currency in circulation grew by Rs 5,01,405 crore amongst January 1, 2019, and January 1, 2020. Over-all, it has long gone up to Rs 27,70,315 crore, up 22% from the preceding 12 months. This is the sharpest increase to date, if the write-up-demonetisation surge thanks to banknote alternative is excluded.

Even though forex in circulation shrunk virtually 20% in FY17 owing to demonetisation, it jumped 37% the following calendar year when contemporary notes have been issued. The typical development for the final decade was 12.6% and for the last 50 several years 13.8%.

In accordance to a paper posted by the RBI, in the previous 50 yrs there had been only 4 events when currency advancement was greater than 17% for three-4 consecutive many years. On a few instances, ie, during 1987-90, 1993-96 and 2005-09, bigger currency need was prompted by somewhat high nominal GDP growth. The the latest surge is irrespective of GDP shrinking.

In 2020, it was uncertainty introduced about by the pandemic that drove folks to hoard extra money above fears of health care or money crisis. When currency in circulation does rise with the enhance in GDP, a current paper released by RBI staff members mentioned the large growth in currency in the course of the last three several years was in spite of minimal nominal GDP advancement.

As Covid-19 conditions in India rose very last yr, deposit advancement slowed and year-on-year progress in currency with the general public accelerated from 11.3% as on February 28, 2020, to 14.5% by finish-March 2020 and to 21% in June 2020.

News reviews this week stated that 35% of all US bucks in circulation have been printed in the very last 10 months — funds made as an consequence of central bank easing.

According to the RBI, this is a global phenomenon. In its August once-a-year report, the RBI pointed out that the improve in forex in circulation was notably sharp in Brazil, Chile, India, Russia and Turkey, as well as in state-of-the-art economies this sort of as the US, Spain, Italy, Germany and France, exactly where the use of dollars is much less.

“The increase in forex in circulation in these countries happened concomitantly with liquidity injecting steps carried out by their central banking companies. They were being also impacted by the Covid-19 build-up of precautionary harmony,” the RBI had stated.