Just more than 50 % of United kingdom motor suppliers feel they are all set for the improvements to motor finance regulations which are being introduced in on January 28.

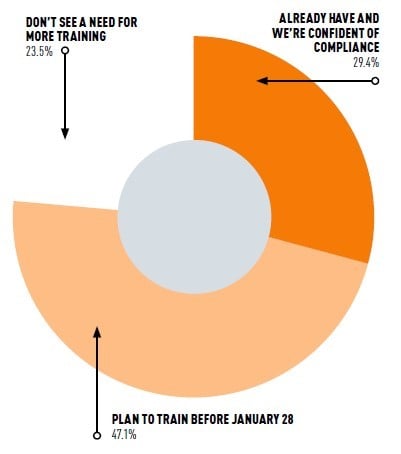

Just about a quarter of respondents to our most recent poll, which requested regardless of whether they were being education team on commission disclosure forward of the January alterations applied by the Fiscal Perform Authority, think there is no added require for staff members education, while marginally a lot more say they’ve now introduced their workforce up to speed.

But when our poll ran concerning November and December almost just one-in-two dealers had been nonetheless organizing to provide in extra training prior to the new rules come info force.

But when our poll ran concerning November and December almost just one-in-two dealers had been nonetheless organizing to provide in extra training prior to the new rules come info force.

Subsequent the Money Conduct Authority (FCA) 2018/19 motor finance review, it has stipulated that from January 28 dealers and brokers will have to prominently disclose that they receive commission from arranging motor finance where knowledge of that fee could have a material effects on the vehicle buyer’s decision to indication.

Keen to be certain people are handled fairly, the FCA has also banned certain commission products which beforehand permitted dealers and brokers to ramp up their prices and earnings.

in December exploration by Close Brothers Motor Finance identified that while 69% of motor suppliers have read about the adjustments only 33% of individuals have really read the FCA’s specifics outlining them.

Seán Kemple, Near Brothers Motor Finance managing director, claimed: “Dealers need to realize the principles and be nicely organized to make adjustments in which wanted, as before long as feasible.

The prospective hazards to car or truck sellers and motor finance homes are enormous – in December the FCA fined banking giant Barclays £26 million for failures in relation to its treatment method of consumer credit customers who experienced monetary troubles.

The FCA’s rules-centered regulation places the onus on registered loan companies and credit rating brokers, these types of as automobile dealers, to be certain prospects get truthful procedure and optimistic outcomes.