JimVallee/iStock by using Getty Illustrations or photos

In my report of July 29, 2021 (below), the motion of the choices markets pointed to a bear market in shares. The objective of this write-up is to critique also the indicators discussed in previous content and look at what they are declaring now.

The enterprise cycle, earnings, and the stock industry

The Peter Dag Portfolio Method and Administration

The organization cycle goes via 4 phases.

Section 1 starts when enterprise needs to replenish inventories, recognizing their amount is as well reduced. The decline in inflation and fascination rates that took area in Stage 4 improves consumers’ paying for power and their willingness to expend. Creation need to improve to meet up with need. The greater demand from customers for uncooked components and funding to improve ability locations a flooring below commodities and curiosity costs.

Section 2 demonstrates the amplified demand from customers triggered by increasing work and profits. Organization must now aggressively replenish inventories. In this phase the economic climate overheats. The abnormal generation places upward pressure on commodities and desire costs, and inflation. Toward the stop of Section 2 commodities, curiosity costs, and inflation increase.

Phase 3 is a crucial position of the company cycle since advancement commences to sputter. Climbing inflation minimizes consumers’ getting electric power. The College of Michigan survey demonstrates increasing consumers’ pessimism about their finance and outlook. Need slows down. The rise in commodities, desire premiums and labor charges start out owning a damaging affect on profitability. Inventories have to have to be diminished to mirror slower desire and preserve margins underneath control.

Phase 4 demonstrates the influence of decreased manufacturing. Commodities, interest fees, and inflation are now declining mainly because of the weak demand from customers and the intense reduction in output to bring stock advancement in line with need. This section will keep on right up until people recognize their getting electric power is improving upon. The College of Michigan study displays consumers’ optimism climbing sharply.

Phase 1 is now underway yet again.

The organization cycle is at the moment in Phase 3, suggesting we are considerably closer to a peak than the bottom of the bear market place and of the financial state.

The Peter Dag Portfolio System and Administration

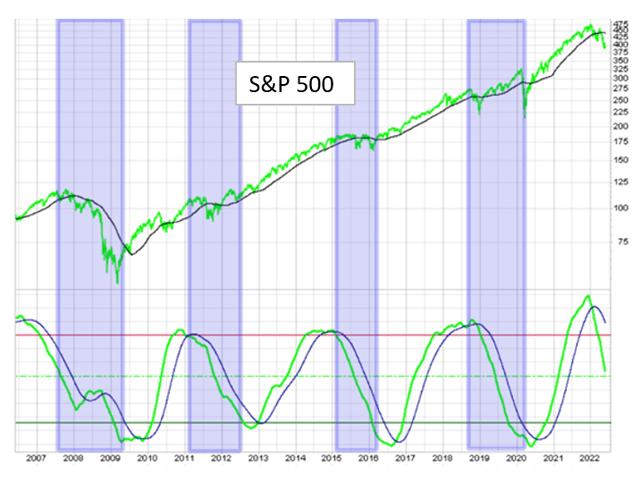

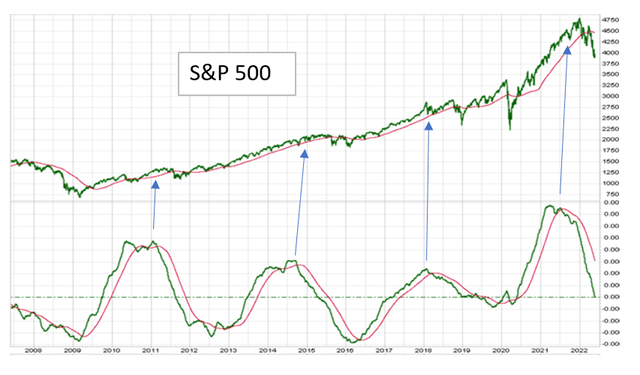

The over chart displays the graphs of the S&P 500 (SPY) in the higher panel and of the enterprise cycle indicator, printed in each individual situation of The Peter Dag Portfolio Strategy and Management, in the reduce panel. The company cycle indicator is computed in authentic-time employing sector facts.

The chart shows how a decrease in the organization cycle indicator, reflecting slowing financial expansion, signals a interval of weakening industry disorders. A increase in the company cycle indicator, reflecting soaring financial progress, details to a robust fairness marketplace.

The Peter Dag Portfolio Approach and Administration

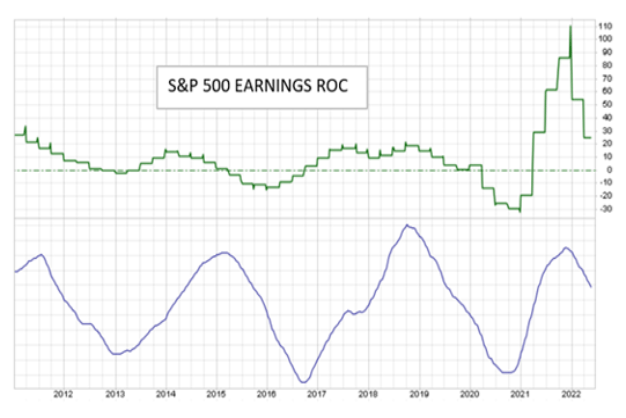

Durations of current market appreciation or declines replicate the cyclical habits of earnings. The over chart exhibits in the higher panel the development in earnings of the S&P 500. The lessen panel displays the company cycle indicator. The alter in earnings follows closely the business cycle. They increase more quickly when the enterprise cycle indicator rises, reflecting more robust financial disorders. They sluggish down when the organization cycle declines, reflecting weaker economic circumstances.

The present developments of the company cycle indicator are down, pointing to slower growth in earnings.

The technique indicator and stock sectors

In an write-up printed 2/29/2021 (in this article), the dialogue focused on the conduct of the eleven sectors of the S&P 500 during many business enterprise cycles.

The Peter Dag Portfolio Approach and Management

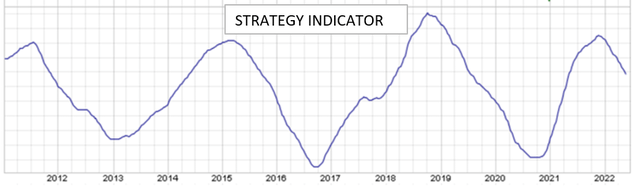

The chart previously mentioned reveals our technique indicator. The graph demonstrates the base of the small business cycle happened in 2020 and the top rated in 2021. The odds favor the bear marketplace to bottom not ahead of the close of 2022, quite possibly in 2023 if the approach indicator follows the historic four-year cycle.

The Peter Dag Portfolio Tactic and Management

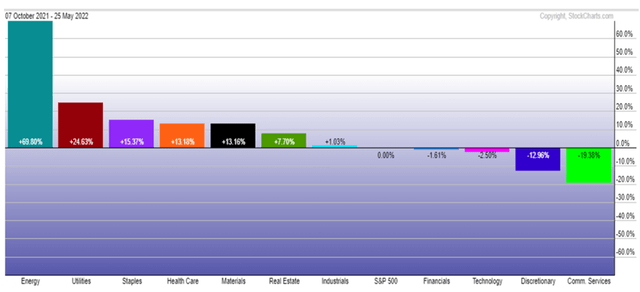

The higher than chart reveals the performance of the sectors relative to the S&P 500 for the duration of the decline of the organization cycle. Considering the fact that Oct 2021, the strongest sectors have been XLU, XLP, XLV, and VNQ – excluding elements and energy. The cyclical sectors underperformed. This is a pattern commonly uncovered when the organization cycle declines, reflecting a weakening financial system.

The action of the sectors confirms the economy is slowing down as mirrored by the decrease of the business cycle indicators and it indicates the most correct strategy is to concentration on defensive sectors.

The choices market and the bear industry

The Peter Dag Portfolio System and Administration

The above chart is the up-to-date variation of the chart proven in the report of July 29, 2021. The higher panel reveals the graphs of the S&P 500. The reduce panel reveals the indicators computed utilizing options sector facts. This gauge is however declining and factors to more current market weak point.

The system of top, coincident, and lagging indicators

The Peter Dag Portfolio Method and Management

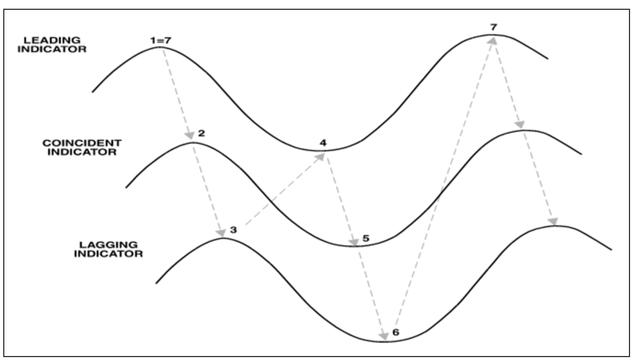

The over chart will help to acknowledge the financial and economical situations getting spot at the base of the bear sector. The earlier mentioned graphs ended up also talked about in detail, including the implication for a bear market place, in my posting of October 26, 2021 (here). The graphs demonstrate the interactions among main, coincident, and lagging economic/money indicators in the course of a company cycle.

For the function of this write-up the essential major indicators are inventory rates, customer optimism, commodities. The coincident indicators are money, production, and profits. The lagging indicators are curiosity fees and inflation.

The previously mentioned chart is saying an economic slowdown (coincident indicators) is preceded by a slowdown in the top indicators. A slowdown in the major indicators is preceded by rising lagging indicators. The main indicators rise pursuing weak point in the lagging indicators.

This is exactly where we stand now. Inflation and interest prices are climbing. The major indicators, these types of as fairness marketplace and shopper optimism, are responding accordingly with equities and purchaser optimism declining.

When will the base in the main indicators (inventory price ranges and consumer optimism) acquire place? The beginning of a new bull market place and rise of the business enterprise cycle will come about when interest premiums and inflation decline, ample to re-establish consumers’ purchasing energy and consequently encourage desire for merchandise and companies.

Critical takeaways

- The business cycle is slowing down, reflecting weakening financial situations. These situations have been heightened by climbing interest premiums, and inflation. Excessive stock accumulation in require to be liquidated for the reason that of slowing demand will lead to further more economic damage.

- This is the time when defensive sectors outperform the market place.

- Earnings will keep on to gradual down, and equities will maintain heading reduce as the economic climate retains slowing down. The company cycle is at this phase (Stage 3).

- The organization cycle will base when fascination premiums, commodities, and inflation exhibit a drop sharp enough to increase consumers’ optimism and raise their purchasing electric power.

- The new bull market place begins as inflation and fascination costs decline, and consumer optimism rises again.

- This is the time when the cyclical sectors begin to outperform the wide sector.

- Historic styles, this kind of as the four-12 months cycle of the system indicator, propose the base of the organization cycle and the inventory sector will take spot no faster than the finish of 2022.