(MENAFN – Iraq Organization News) By Ahmed Tabaqchali, CIO of Asia Frontier Cash (AFC) Iraq Fund .

Any thoughts expressed are these of the author, and do not always replicate the views of Iraq Business News .

Sector Evaluate: “Inventory Market Rallies on Forex Devaluation”

For Iraq and its fairness industry the 12 months ended the similar way it started, with a bang that is substantially louder than its influence.

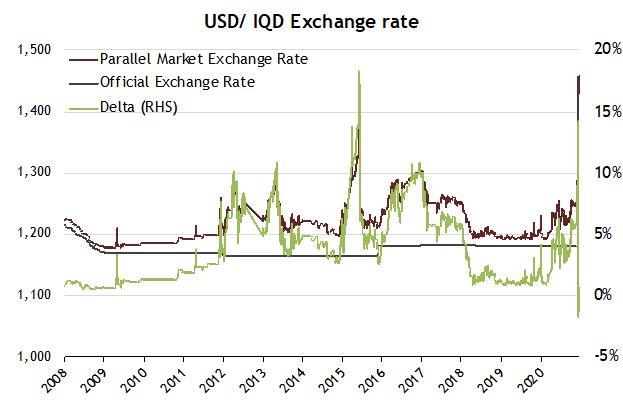

The official IQD trade level as opposed to the USD was reset from 1,190 to the new USD amount of 1,460 on December 20th – or a de facto devaluation of 22.7%.

The IQD’s parallel market’s Forex price tag elevated all through the calendar year, from about 1,203 at the start off of 2020, reflecting several things. Beginning with the momentous events at the beginning of the calendar year that raised the spectre of a US-Iran proxy war fought in the nation, followed by the total lockdown from mid-March and the rolling lockdowns that slash the performing weeks to 4 times all over the summer months, and eventually by the rumours of a devaluation as previous noted on listed here in Oct .

By the conclusion of November, the IQD parallel marketplace Fx rate was about 1,250 IQD to the USD and during December greater to about 1,300-1,350, just ahead of the devaluation was designed formal. Nevertheless, just after at first expanding to about 1,470, trading at a top quality to the official cost, it commenced to decrease in the pursuing times to about 1,390, investing at a price cut to the formal rate, prior to soaring increased than the formal trade fee as the thirty day period concluded.

[…]

(Resource: Central Lender of Iraq, Iraqi International Trade Houses, AFC Analysis, facts as of December 31st)

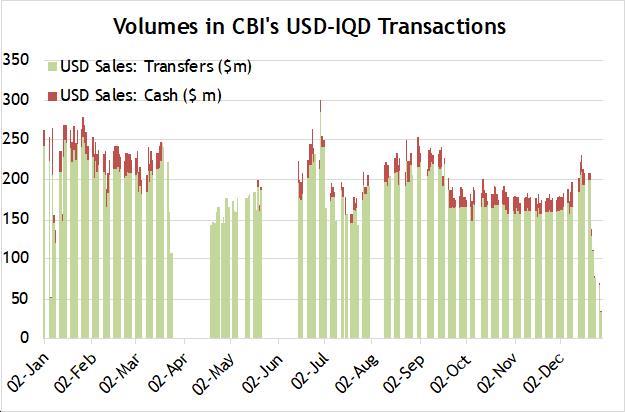

Moreover, USD-Iraqi Dinar (IQD) transaction volumes done by the Central Financial institution of Iraq (CBI), declined significantly in the two months pursuing the devaluation reflecting marketplace uncertainty and confusion in excess of irrespective of whether the devaluation would be challenged by parliament. Prior to the announcement these volumes had been commencing to display a pick-up in the initially two weeks of December immediately after a number of months of very low volumes – day-to-day volumes in the course of July-November had been on ordinary 86% of the stages that prevailed from January to mid-March.

[…]

(Source: Central Lender of Iraq, Iraqi Overseas Exchange Homes, AFC Research, details as of December 31st)

The past time the IQD went by way of a important devaluation was in the early 1990s in reaction to the United Nations (UN) embargo next the invasion of Kuwait, and in advance of that all through the Iraq-Iran war in the 1980s. The formal exchange fee, last mounted at USD 1 = IQD .31 in 1982, remained the same till the rate and the guidelines governing the convertibility of the currency adjusted subsequent the US invasion in 2003.

Nevertheless, the parallel market place rate, or what was referred to pre-2003 as the black-market place charge, declined meaningfully during the 1980s to about USD 1 = IQD 1.86, and nosedived to about USD 1 = IQD 3,000+ by 1995 as the government resorted to printing revenue to fulfill its expenses as its oil revenues came to an finish following the UN embargo in reaction to the invasion of Kuwait.

The UN’s “Oil-for-Foods programme” in 1995 improved the amount somewhat but it remained at these elevated levels until 2003. Subsequent the invasion, new IQD notes ended up issued to change the old notes and the charge began to recuperate with the earliest Central Lender of Iraq (CBI) information displaying an typical new formal level of USD 1 = IQD 1,949 in October 2003. The stabilisation of the place in the pursuing yrs brought with it a meaningful recovery in the trade charge as can be found from the over chart.

However, the present devaluation is really distinctive from those of the previous. The main cause was to extend the government’s oil revenues to go over extra of its expenses and thus to preserve the country’s foreign reserves. Nevertheless, a by-merchandise of the devaluation was to tackle the country’s loss of competitiveness vs . its main buying and selling associates whose currencies depreciated noticeably compared to the USD, and as a result the IQD, more than the decades as argued in the government’s reform software, identified as the “White Paper”.

This argument was vindicated somewhat by the subsequent strong rally of the Iraq Inventory Exchange (ISX), as mentioned under. Iraq’s however significant oil revenues estimated at USD 42.3 bn based mostly on an approximated typical Iraqi oil price of USD 38.54 for every barrel in 2020, and USD 51.5 bn in 2021 dependent on an estimated average Iraqi oil price of USD 42. for every barrel, with foreign exchange reserves of USD 54.9 bn as of early December ought to preclude the necessity for a even further devaluation.

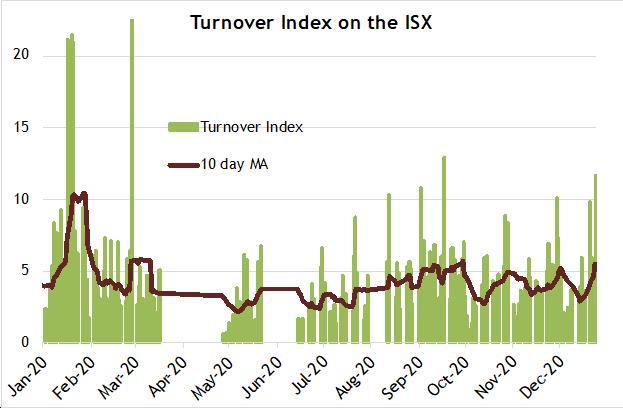

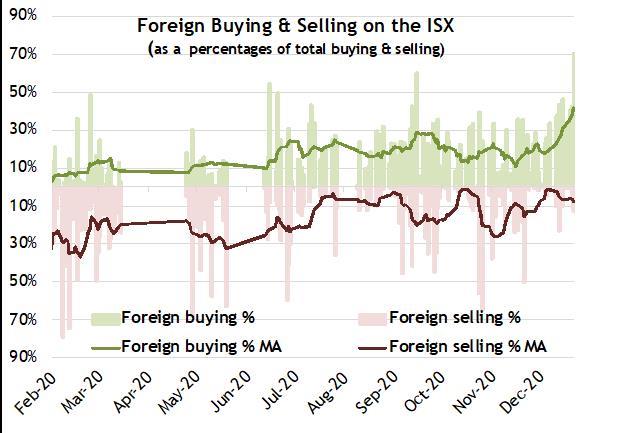

The equity sector reacted exceptionally positively to the news of the devaluation, with the Rabee Securities RSISX Index rallying 8.7% in area currency conditions in the five times in between the announcement of the devaluation and the closing of the month. Among the the top rated gainers in the same 5 times were Baghdad Delicate Beverages (IBSD) up 19.6%, Countrywide Financial institution of Iraq (BNOI) up 9.5%, Asiacell (TASC) up 5.9%, and Lender of Baghdad (BBOB) up 5.1%. The most promising facet of the rally put up devaluation has been the major increase in turnover following a extremely subdued get started to the thirty day period, as nicely as the improved overseas buying as can be seen in the two charts down below.

[…]

[…]

(Resource: Iraq Stock Trade (ISX), AFC Research as of 24th December)

Though the devaluation is an adverse celebration, the reaction of the equity market place and the elevated foreign participation implies that the modify is beneficial for equities. Even though the missing pieces of Iraq’s re-ranking are several and will just take time to materialize, this optimistic reaction to the devaluation indicates that the party could start off the system of Iraq’s re-ranking – which from a prolonged-time period viewpoint is good for the fairness market.

Absent from the drama of the devaluation and the market’s action, Xmas was a lot more exclusive than common this year as parliament voted unanimously to create Xmas as an yearly countrywide getaway , making lasting the government’s final decision two decades before. Parliament’s vote was preceded by a Vatican announcement that Pope Francis will visit Iraq in March 2021, the initially visit by a pope to Iraq and the very first visit by the existing pope considering the fact that the pandemic commenced.

Iraq’s leaders attended Christmas Mass, such as the President and the Prime Minister, contacting for the security of Iraq’s Christian minority and reaffirming the continuity with Iraq’s Christian past – before the sacking of Baghdad by the Mongols in 1258 and the Tamerlane in 1410, the city was a major globe centre of Christianity in which “… the Iraq-primarily based Church of the East had bishops and monasteries as significantly east as Beijing.” Supply: Heirs to Forgotten Kingdoms . Still probably the most poignant was the Key Minister’s stop by to the church of “Our Girl of Salvation” – an Assyrian Christian church that survived two horrible terrorist assaults in 2004 and 2010, with the previous a single an assault at a Sunday Mass that led to more than 52 fatalities.

Be sure to click on listed here to down load Ahmed Tabaqchali’s whole report in pdf format .

Mr Tabaqchali (@AMTabaqchali ) is the CIO of the AFC Iraq Fund, and is an professional capital marketplaces professional with about 25 years’ encounter in US and MENA markets. He is a non-resident Fellow at the Institute of Regional and Intercontinental Studies (IRIS) at the American University of Iraq-Sulaimani (AUIS), and an Adjunct Assistant Professor at AUIS. He is a board member of the Credit Financial institution of Iraq.

His remarks, views and analyses are particular sights and are supposed to be for informational purposes and standard interest only and must not be construed as person investment decision guidance or a suggestion or solicitation to acquire, provide or hold any fund or protection or to adopt any investment system. It does not represent legal or tax or expenditure suggestions. The data provided in this substance is compiled from resources that are considered to be reputable, but no warranty is manufactured of its correctness, is rendered as at publication date and may improve with out recognize and it is not supposed as a finish evaluation of every materials simple fact with regards to Iraq, the location, market or financial commitment.

MENAFN06012021000217011061ID1101390749

Legal Disclaimer: MENAFN delivers the info “as is” devoid of guarantee of any form. We do not acknowledge any responsibility or legal responsibility for the accuracy, content, illustrations or photos, films, licenses, completeness, legality, or dependability of the information and facts contained in this report. If you have any grievances or copyright difficulties linked to this short article, kindly contact the supplier earlier mentioned.