Treasury Secretary Janet Yellen has claimed that she will function with president Joe Biden to combat currency manipulation.

Extra remarks

- Will not change China tariffs till allies consulted.

- Require ‘new approach’ for significant China tension.

- US to get on China’s abusive, unlawful procedures.

- Will use a comprehensive array of instruments to counter china methods, comprehensively overview credit card debt administration practices to analyse weighted-common maturity of the credit card debt.

Sector implications

Some sturdy language coming from the Biden administration directed at China on Working day Two of office environment.

On Day A person, China imposed sanctions on outgoing Donald Trump officials just as the inauguration was using location.

This act enraged the new administration.

“Imposing these sanctions on Inauguration Day is seemingly an try to play to partisan divides,” Emily Horne, a spokeswoman for President Biden’s Nationwide Security Council, advised Reuters on Wednesday.

“President Biden appears to be forward to doing work with leaders in both equally functions to situation The usa to out-contend China.”

The world’s two largest economies became locked in a detrimental trade war in the course of Trump’s time period, and that looks established to go on.

While Biden is anticipated to strike a more predictable and diplomatic tone than former President Trump, the new administration isn’t likely to simplicity up on Beijing also a lot when it arrives to tech and trade.

”China is undercutting American companies by dumping merchandise, erecting trade barriers, and supplying absent subsidies to companies,” Yellen advised the Senate Finance Committee this 7 days, echoing some of the Trump administration’s most significant criticisms of China.

There are plenty of free ends to the trade settlement in between the US and China, a topic that markets will be on monitoring very intently.

The USD will most likely encounter spikes in periodic small-phrase volatilities as vital functions of the trade war unfold under the Biden administration.

In the very long-term, the general performance of the USD will rely on the US and world wide financial effectiveness, the Federal Reserve, adopted financial guidelines of central financial institutions about the globe and fiscal monetary plan pertaining to covid.

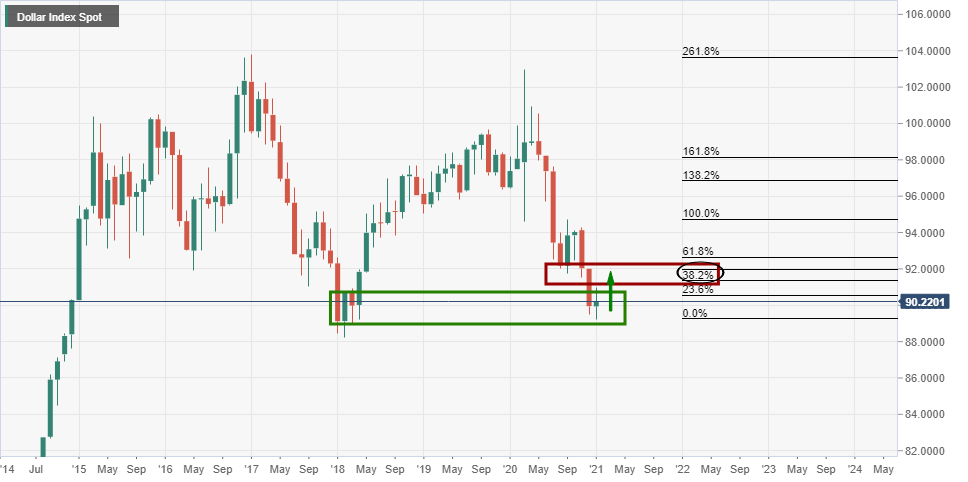

DXY every month chart

The month-to-month chart implies the probability of a continuation of the recent correction.

Next such a transfer into a prior construction, in this circumstance, a demand from customers zone, a correction would be expected to at least the 38.2% Fibonacci, specifically exactly where it fulfills prior stricture, in this case, prior lows.

Trade war sentiment and demand for US Treasuries coupled with inflationary expectations and a less dovish Fed leading to rising US yields could be the catalyst for a interval of US greenback energy.