30-second summary:

- 2020’s most valuable companies were Apple (US$1,993 billion), Microsoft (US$1,588 billion), Amazon (US$1,578 billion), and Google (US$1,046 billion).

- Apple made US $65 billion in consumer electronic goods’ sales for Q4 2020, making it the leader.

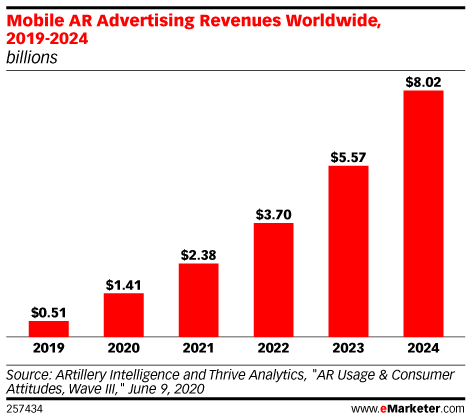

- How the iPhone 12 series promises to will enhance the AR experience which will inject potential spend into AR advertising that will cross $8 billion by the end of 2024.

- Just 36% of marketing leaders have a measurable revenue attribution strategy in place while a mere 15% are in the process of rolling out a strategy.

- 95% of marketing leaders are seeing success from an implemented revenue attribution strategy while 31% described this success as best-in-class.

- Top four departments involved in executing a revenue attribution strategy are – Marketing, Sales, Board of Directors, and Customer Service.

- According to Statista, the digital advertising market is expected to reach US $398 billion in revenues for 2021.

- The global AI revenue is forecasted at US $35 billion in 2021 with a catalyzed 3X growth up to US $126 billion by 2025.

- North America (US $15 billion) is poised as the largest market for AI software with Asia-Pacific coming in second (US $10 billion), and Europe third (US $8 billion).

- Buckle up for details on challenges, key industry players, patents, and a lot more.

Hello, 2021! Marketing leaders have struggled to swim abreast the ebbs and flow of 2020 and after braving these tides there lies an increased pressure on proving ROI and revenue success through their marketing efforts and investments. This week, we’re giving you a periscopic view of the revenue attribution strategy for 2021, challenges, the industry leaders, and refined details on forecasts for digital advertising, AI, and how Apple will potentially bring in billions for AR advertising.

Digital titans

We spotted how 2020 has been for the industry titans and what 2021 holds. A fine comb of Statista’s latest ‘Digital Economy Compass’:

- Google advertising faced a -8% loss (vs 2019) closing at US $29.9 billion in global revenues

- Facebook stock prices continually increased till Q3 2020, with US $21.1 billion in revenue and US $7.8 billion in net income (27% growth vs Q3 2019)

- Facebook and Instagram’s cost-per-mille (CPM) & cost-per-click (CPC) in US$ by October 2020 was 2.70 and 0.35 respectively

- Gaming stands tall as a sweet spot for investments, acquisition, and growth as Microsoft strengthened its COVID-19-resilient gaming business with an investment in ZeniMax Media

- 2020’s most valuable companies were Apple (US$1,993 billion), Microsoft (US$1,588 billion), Amazon (US$1,578 billion), and Google (US$1,046 billion)

The big Apple spotlight

Apple has been one of the most adaptive in terms of product and sales strategy that centred around COVID-19’s impact on consumer behavior resulting in an 18% growth in total COVID-19 related products which further segmented into –

- Wearables, Home and accessories: +23% (vs 2019)

- Service: +17% (vs 2019)

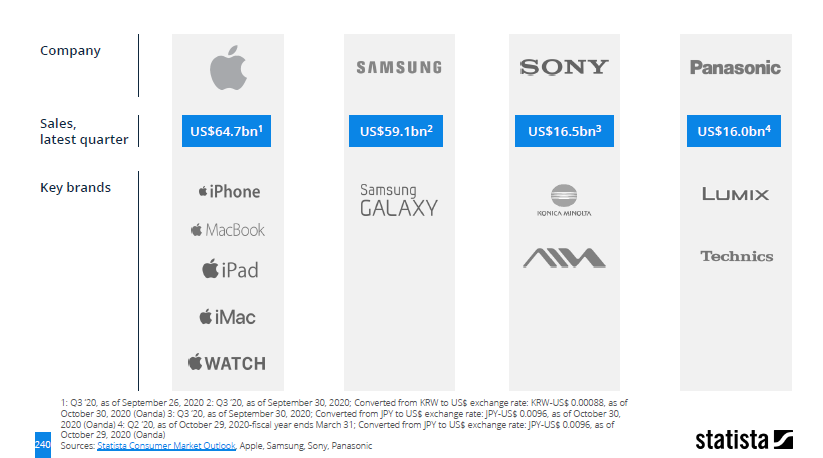

Apple revenue 2020 – The consumer electronic goods leader

Apple made US $65 billion in consumer electronic goods’ sales for Q4 2020, making it the leader. As mentioned above the Q1 2020 adaptability to new consumer behaviors has helped Apple remain the front runner.

The AR move and ad spend boost

With its latest iPhone 12 series promise the most sophisticated back-facing Light Detection and Ranging (Lidar) camera which will enhance the AR experience which will inject potential spend into AR advertising that will cross $8 billion by the end of 2024.

Revenue attribution – But what’s the strategy?

DemandLab’s ‘Revenue Attribution Outlook Survey’ surveyed marketing leaders about their plans, challenges, and budgets for revenue attribution, and here are some key findings:

- 95% of marketing leaders are seeing success from an implemented revenue attribution strategy while 31% described this success as best-in-class

- Top four departments involved in executing a revenue attribution strategy are – Marketing, Sales, Board of Directors, and Customer Service

- 58% agree to be using a mix of both internal and external resources for revenue attribution implementation and optimizations

- 10% of marketing leaders have outsourced the data aggregation part of revenue attribution strategy

Current scenario, budget allocation, and benefits

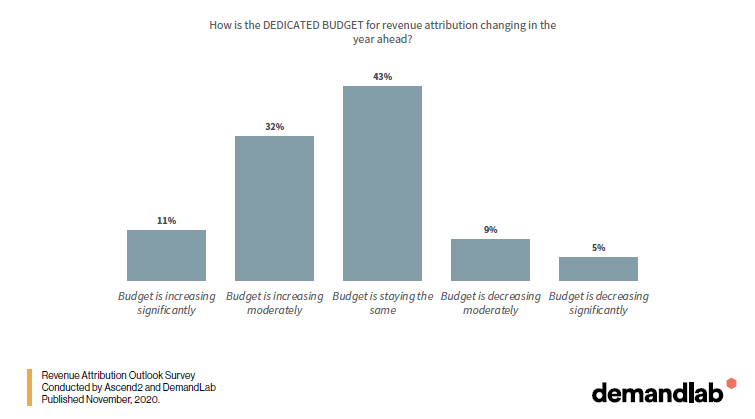

Just 36% of marketing leaders have a measurable revenue attribution strategy in place while a mere 15% are in the process of rolling out a strategy.

43% of marketing leaders are maintaining their budgets while 32% are increasing their budgets on revenue attribution.

Top five benefits of having a revenue attribution strategy

Executives also saw these as the top five benefits of having a revenue attribution strategy:

- Better decision making – 59%

- Marketing and sales alignment – 44%

- Campaign optimization – 38%

- Increased channel effectiveness – 37%

- Attribution of ROI to marketing – 29%

Most challenging channels to analyze revenue attribution

Proving marketing ROI stands as a major challenge, however, this list details the exact channels that are pain points for analyzing revenue success:

- Social media marketing (SMM) – 44%

- Content marketing – 39%

- Display advertising – 38%

- Email marketing – 33%

- Video marketing – 28%

- Paid search – 23%

- SEO – 18%

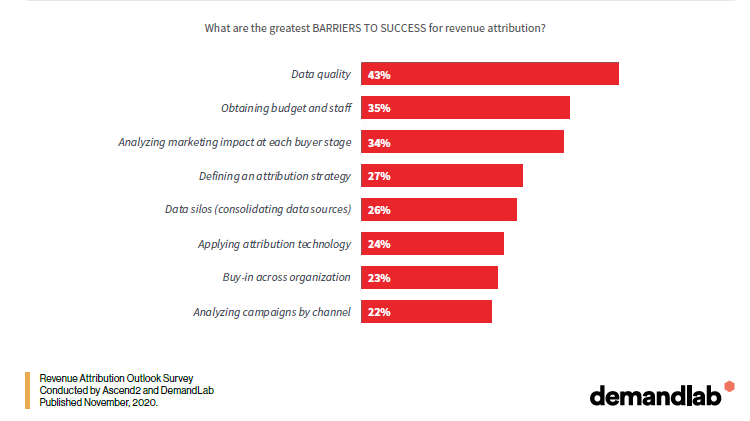

Revenue attribution strategy – Success barriers

Collecting, analyzing, and sharing the data holds a key place in measuring success. These were the barriers that stood:

Digital advertising forecast 2021 – Deep dive

According to Statista’s latest ‘Digital Economy Compass’ the digital advertising market is expected to reach US $398 billion in revenues for 2021 and further expand to US$470 billion by 2025.

Digital advertising 2021 – Market segments

Search advertising will have a lion’s share in the market, here is a complete breakdown of the projected market revenues for 2021:

- Search advertising – US $175 billion

- Social media advertising – US $114 billion

- Banner advertising – US $59 billion

- Video advertising – US $31 billion

- Classifieds – US $20 billion

In fact, this hierarchy will continue to remain proportionate until 2025.

Key industry players

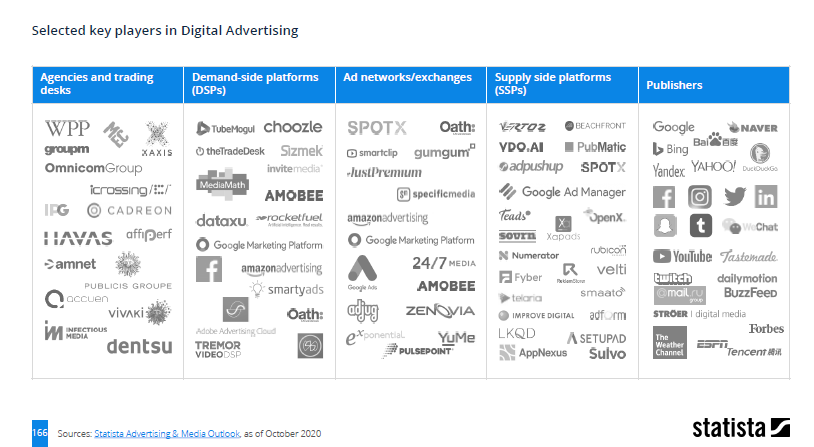

There’s a wide spectrum of verticals in the digital advertising industry namely –

- Agencies and trading desks

- DSPs (Demand side platforms)

- Ad networks

- SSPs (Supply-side platforms)

- Publishers

Statista created an interesting landscape view of the key industry players as shown below.

AI forecast 2021 – Industry, leadings regions, and patent holders

The global AI revenue is forecasted at US $35 billion in 2021 with a catalyzed 3X growth up to US $126 billion by 2025. The industry is already seeing thousands of patents from tech giants, these are the top patent holders of AI applications:

- Microsoft

- IBM

- Samsung

- Qualcomm

According to Statista’s forecast for 2021, North America (US $15 billion) is poised as the largest market for AI software with Asia-Pacific coming in second (US $10 billion), and Europe third (US $8 billion).

ClickZ readers’ choice for the week

This week our readers have been keen on gleaning insights on how, where, and when they can reach their target customers through email and content marketing, followed by trends in retail and marketing outlined for 2021.

- Key Insights: 2021 Strategic pearls on email and content marketing

- Five retail and marketing trends for 2021

- The digital marketing forecast for 2021